- Joined

- Jun 30, 2017

- Messages

- 234

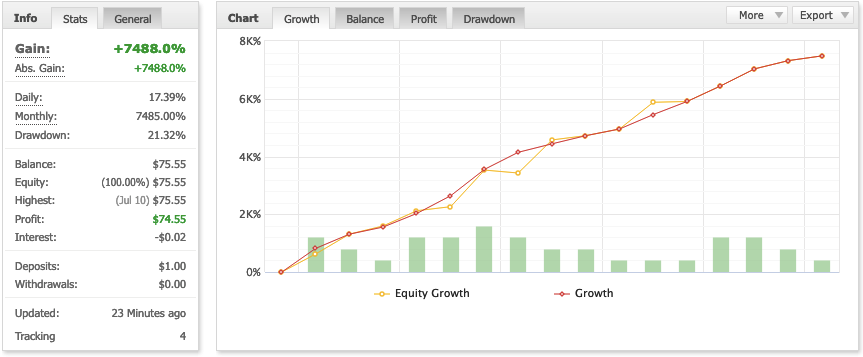

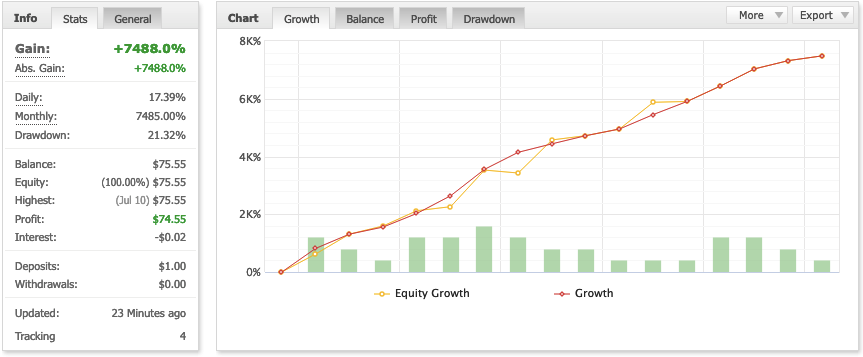

Alright, let me give you a quick backstory. I've been in the trading game for a bit over 10 years, and now I've decided to embark on a unique challenge—something nobody has attempted before. Just to be clear, I'll still be doing my regular trading with my usual accounts and clients; this is just a side project. The trades will be similar, but the risk is different. Currently, the account stands at $75.

Now, for those familiar with trading, you know that growing a $1 account is close to mission impossible. First off, you need a broker that allows leverage above 1:1000 because 0.01 lot is the minimum trading size. Then, a hefty dose of skill comes into play—thankfully, my experience has got that covered. Lastly, a bit of luck doesn't hurt. Starting with just $1 means I had a mere 6-pip range to work with, and anything over that would spell doom for the account. The first entry had to be 99% spot-on. It gets a bit easier as the account grows, but the initial steps are quite the tightrope walk.

Given the unpredictable nature of the trading world—brokers can go down, regulations may change—I've decided to break down this journey into 5 phases. First up, going from $1 to $100. After that, I'll open a new account, transfer the funds, and aim for the $100 to $1000 phase. The progression continues with $1k to $10k, then $10k to $100k, and finally, the stretch from $100k to a million, if it ever reaches that point. I might even explore different brokers for each phase; that's something I'll decide along the way.

Currently, I'm using myfxbook to track the status of my account.

Now, for those familiar with trading, you know that growing a $1 account is close to mission impossible. First off, you need a broker that allows leverage above 1:1000 because 0.01 lot is the minimum trading size. Then, a hefty dose of skill comes into play—thankfully, my experience has got that covered. Lastly, a bit of luck doesn't hurt. Starting with just $1 means I had a mere 6-pip range to work with, and anything over that would spell doom for the account. The first entry had to be 99% spot-on. It gets a bit easier as the account grows, but the initial steps are quite the tightrope walk.

Given the unpredictable nature of the trading world—brokers can go down, regulations may change—I've decided to break down this journey into 5 phases. First up, going from $1 to $100. After that, I'll open a new account, transfer the funds, and aim for the $100 to $1000 phase. The progression continues with $1k to $10k, then $10k to $100k, and finally, the stretch from $100k to a million, if it ever reaches that point. I might even explore different brokers for each phase; that's something I'll decide along the way.

Currently, I'm using myfxbook to track the status of my account.

Last edited by a moderator: